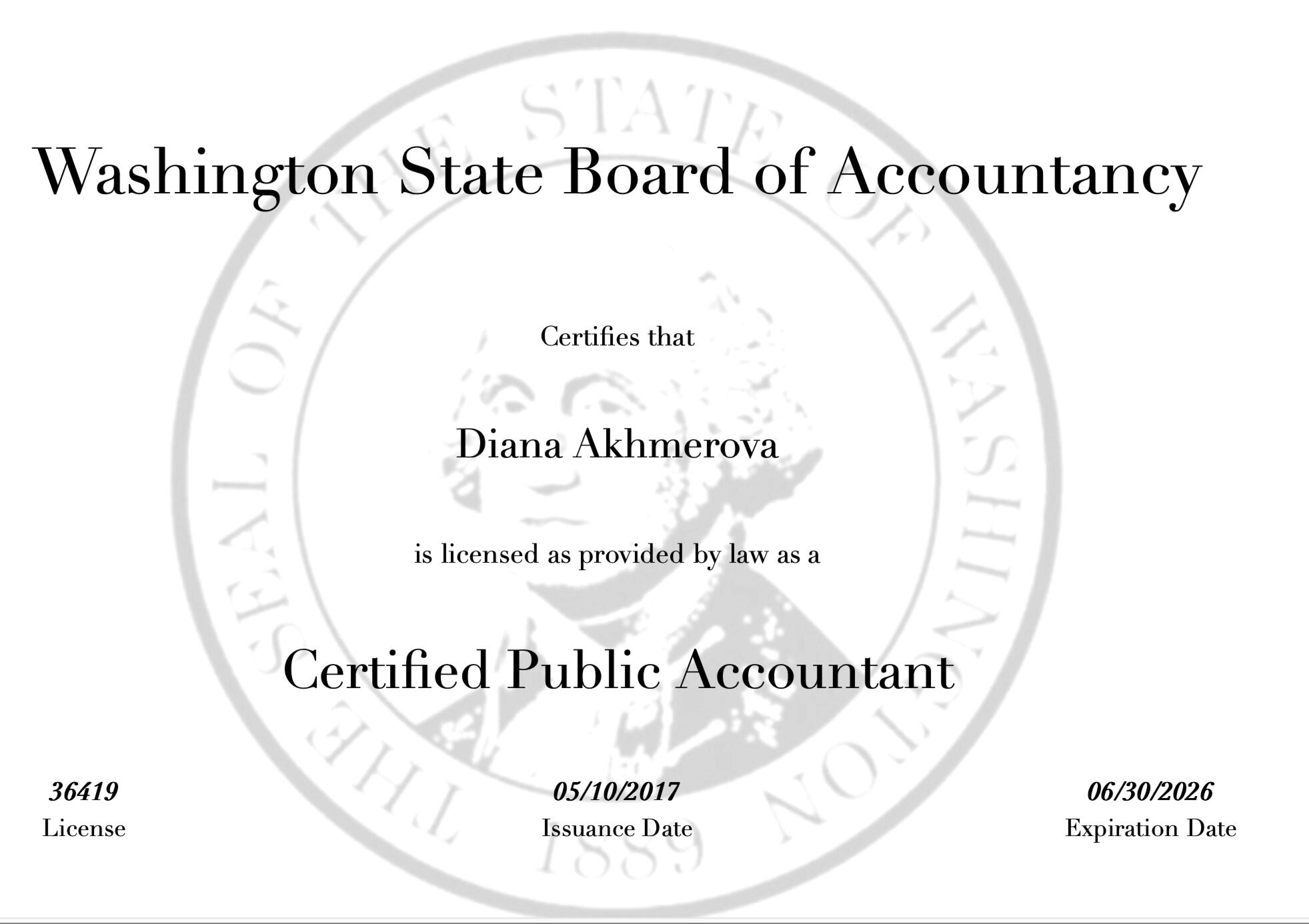

Diana Akhmerova

Certified Public Accountant

Washington state CPA License # 36419

California state CPA License # 122537

If you’re reading this, chances are you’re feeling overwhelmed by your finances—and I want you to know, you’re not alone.Maybe you’ve received an unexpected letter from the IRS, fallen behind on tax filings, or never set up proper bookkeeping for your business. Perhaps you’re going through a divorce and trying to untangle finances, just won a multi-million dollar lawsuit and need smart tax strategies, or recently lost a loved one and now have to navigate estate and inheritance taxes. Or maybe your longtime CPA retired, and now you're wondering who you can trust.These are real-life situations my clients come to me for help with every day. And no matter what financial challenge you’re facing, I’m here to guide you through it.I work with business owners, investors, families, and individuals navigating big financial decisions and tough transitions. I take the time to understand your unique situation, break things down in plain English, and give you clear, strategic guidance so you can move forward with confidence.I’m truly glad you’re here. Let’s chat and start making sense of it all together.

Contact Information

Phone: (206) 460-1178

Email: hello@seattleaccountants.comOffice Address (By Appointment Only):

1201 3rd Ave, Suite 2200, Office 23-111, Seattle, WA 98101

Every client's needs are unique. We serve clients not only in Washington state but throughout the USA, and we also support international businesses operating in the United States or serving U.S. customers. Our final fee quote depends on the volume of transactions, the complexity of the situation, and the urgency of your needs. Below, you'll find the fees for our most popular services. If you don't see what you're looking for, please reach out for a customized quote.

30-Minute Consultation – $175

Proactive Tax Planning & Advisory Packages

Our focus is on helping you keep more of what you earn through strategic, year-round tax advice—not last-minute tax prep.

| Foundations Package $999/year | Growth Package $2,499/year | Wealth Package $4,999/year |

|---|---|---|

| For individuals with annual income under $250,000 | For individuals and families with annual income between $250,000 and $1 million | For individuals and families with annual income over $1 million |

| One comprehensive tax planning session per year; IRS and state tax estimate calculations; high-level review of current tax position; basic email support throughout the year; personalized checklist for tax return prep | Two planning sessions per year (spring & fall); mid-year tax projections and optimization strategies; advice on investments, retirement, charitable giving; year-round email support + one quick call per quarter; audit risk mitigation guidance | Ongoing strategic planning (quarterly or as needed); business + personal tax integration (if applicable); executive compensation, stock options, and estate tax strategies; collaboration with your attorney or financial advisor; VIP priority support and direct access to Diana Akhmerova, CPA |

Income Tax Return Preparation Fees

| Tax Return Type / Benefits | Essential | Priority | Elite VIP |

|---|---|---|---|

| Turnaround Time | 30 days | 7 days | 24 hours |

| Communication | Email only | Priority email and phone support | Email, phone and 24/7 direct line to Diana Akhmerova, CPA |

| Audit Support | None | Review of IRS communication(s) and advice via email | Full IRS representation |

| Tax Advisory & Planning | None | One mid-year tax planning session | Unlimited tax advisory & planning services, advanced tax strategy & wealth preservation guidance |

| Form 1040 (Individual) - annual income less than $250,000 | $450 | $650 | $750 |

| Form 1040 or Form 1040 + Schedule C / Schedule E (this price applies if you are a sole proprietor, independent contractor, have rental income, or have an annual income in excess of $250,000) | $800 | $1,000 | $1,500 |

| Form 1120 (C-Corp) | $800 | $1,000 | $1,500 |

| Form 1120-S (S-Corp) | $800 | $1,000 | $1,500 |

| Form 1065 (Partnership) | $1,500 | $3,000 | $5,000 |

| Form 1041 (Estate & Trusts) | $1,500 | $2,000 | $2,500 |

Bookkeeping, Accounting, Tax & CFO Services For Small Business Owners

| Service / Benefits | Essential Books | Growth Books | CFO Concierge |

|---|---|---|---|

| Price | $500-$2,000 / month | $1,000-$5,000 / month | $ 2,000-$30,000 / month |

| Reconciliations | Quarterly | Monthly | Daily |

| Financial Reports | Quarterly | Monthly | Real-time dashboards |

| State and Local Tax Compliance | Included | Included | Included |

| Payroll Processing | Not included | Optional add-on | Included |

| Advisory Services | None | Cash flow forecasting | Full strategy & budgeting |

| Business Tax Return (1040 Schedule C, 1120, 1120-S, 1065) | Included | Included | Included |

Hey there!Thanks so much for stopping by—I’m really glad you’re here. Let me introduce myself: I’m Diana, a CPA with a Master’s in U.S. Taxation, and I’m currently working toward becoming a tax attorney. I’m also a self-made millionaire and a business owner, so I know firsthand the challenges that wealthy individuals and entrepreneurs face. I’ve been in your shoes, and I’m here to help you navigate those complexities with confidence.My journey hasn’t been a straight path—it’s been full of twists and turns. I grew up in the Soviet Union, immigrated to the U.S., and built my life from the ground up as a single mom. Along the way, I’ve learned the value of resilience, hard work, and having someone you can trust in your corner. Those experiences shaped who I am today and how I approach my work.I started my career at some of the biggest accounting firms in the world—PwC, EY, and BDO—where I cut my teeth in audit services. Later, I took on leadership roles like Controller at a sustainability startup and Vice President of Finance and HR at a growing data center company. Those experiences taught me how to tackle complex financial challenges while keeping people at the heart of everything I do.When the pandemic hit, I realized how much I wanted to use my skills to help others during uncertain times. That’s why I started my own firm, Seattle Accountants Professional Corporation. My goal was simple: to provide personalized, compassionate support to people and businesses who need it most. Whether it’s helping a family office in Hawaii, supporting local businesses in the Pacific Northwest, or guiding individuals through their financial goals, I’ve made it my mission to be a trusted partner for anyone looking for clarity and confidence in their finances.I’m also a lifelong learner—always striving to grow and expand my knowledge. I recently completed my Master’s in U.S. Taxation, and I’m now pursuing a law degree to better serve my clients. Why? Because I truly believe that when you know more, you can do more—for yourself and for others.At Seattle Accountants Professional Corporation, my team and I are here to offer so much more than just accounting services. We’re here to listen, to truly understand your unique story, and to help you achieve your goals—whether that’s saving on taxes, growing your wealth, tackling personal finance challenges, or even overcoming debt. I know how overwhelming financial stress can be, and I’m here to help you feel more in control and confident about your money. From bookkeeping and payroll to tax advisory, CFO services, and personalized financial guidance, we’re dedicated to providing solutions that are as unique as you are. Let’s work together to create a plan that works for your life and your goals.I’d love the chance to get to know you and see how we can work together to make your financial journey a little easier and a lot more rewarding. Let’s connect soon—I can’t wait to meet you!Diana Akhmerova, CPA, MST

CEO

Seattle Accountants Professional Corporation

Privacy Policy

Updated: 02/02/2025The following is the privacy policy of Seattle Accountants Professional Corporation as it pertains to the collection and use of personal information collected by its websites (https://seattleaccountants.com and https://daseattlecpa.com). We implement appropriate technical and organizational measures to protect your personal data from unauthorized access. This policy does not apply to information we process as a data processor or service provider on behalf of our clients.The Collection, Sharing, and Use of Personal Information

We collect personal information by tracking activities via “cookies” (cookies are small pieces of information stored on your computer’s hard drive, not on our website). Personal information is also collected when you voluntarily submit your contact information to us via website form submission or by emailing or calling us. This information includes first and last names, company/organization name, email address, and demographic descriptor.We do not rent or sell your information. We do not share it with any third party unless it is necessary to fulfill a request or inquiry from you. If required to by law, we reserve the right to disclose your personally identifiable information.We use personal information for internal purposes, such as responding to an inquiry you have submitted, establishing marketing trends and demographics, or site administration. Unless you have consented (or, “opted in”) to receive our email communications – such as newsletters, events, timely alerts, or other promotional emails – you will not receive these communications from us. There is no penalty nor discrimination for opting out of our communications or exercising your privacy rights.Our services are not designed for minors under 16. If we discover that an individual under 16 has provided us with personal information, we will close the account and delete the personal information. We may, where permitted by law, retain certain information internally for lawful purposes.Controlling and Accessing Your Own Data

If you opted-in to receive our email communications and then decide to opt-out, you may do so by clicking the “unsubscribe” link in the footer of the email.If you wish to:

- See the data we may have about you,

- Receive a copy of the data,

- Modify or delete the data, or

- Talk to us regarding your concerns about the data,please contact us at hello@seattleaccountants.com, call us at (206) 460-1178. To validate your request and further protect your data and privacy, we will verify your identity by asking you to send the request using the original email address that was used to create your data profile and provide proof of a government-issued ID. Depending on the nature of the request, additional verification of your identity may be required to prevent fraudulent requests for access to your data.Securing Your Data

We value your privacy and security. We take appropriate measures to protect your personal data from unauthorized access. We use third-party providers/services that encrypt data at-rest and in-transit using industry-standard encryption protocols. All credit card data is processed by PCI-compliant third-party vendors.

Client Confidentiality Policy

Updated: 02/02/2025We use the information our clients provide to us in accordance with signed service agreements.To prevent unauthorized access, maintain data accuracy, and ensure the correct use of information, we have put in place appropriate physical, electronic, and managerial procedures to safeguard and secure the information we rely upon to conduct business.Seattle Accountants Professional Corporation agrees that confidential information received from its clients shall be treated as private, and safeguarded with all reasonable means. Seattle Accountants Professional Corporation will not make public or intentionally disclose its clients’ confidential information to any third party without first receiving authorization. In the event that confidential information is lost or stolen, Seattle Accountants Professional Corporation agrees to promptly notify affected clients.

Security Overview

Updated: 02/02/2025Seattle Accountants Professional Corporation is committed to safeguarding the information that our clients have entrusted to us. Our goal in securing our network, systems, and information is to strike the correct balance between operational efficiency and protection against unauthorized access, intrusion, and theft.Security Measures

Seattle Accountants Professional Corporation requires, implements, and maintains industry-standard safeguards and utilizes commercially reasonable efforts to secure our clients’ data during transmission (“in-transit”) and while stored (“at-rest”). Where appropriate, we employ third-party hosted services that provide security protections for our clients’ data that are at least as protective as those used for our own organizational data.Security Model

Seattle Accountants Professional Corporation’s security model integrates internal information security policies and procedures with traditional security platforms, an autonomous security solution, as well as a managed security solution. This multi-layer, defense-in-depth approach increases overall security and reduces risk.Training and Compliance

Seattle Accountants Professional Corporation requires its employees to complete annual security refresher training and monthly security awareness training to remain informed of current security threats. We maintain a security compliance program that includes independent third-party assessments, continuous monitoring of internal and external vulnerabilities, dark web monitoring, annual network penetration testing, periodic internal security assessments, and ongoing review and improvements of the security program in response to changes in the threat landscape.Limitations

While Seattle Accountants Professional Corporation strives to protect client information, no security program can provide absolute security due to the inherent nature of the Internet and digital technologies. As such, we cannot guarantee that client information will always be completely secure from intrusions. However, we strive to minimize risk and prioritize security in all our business decisions.Client’s Responsibility

Clients acknowledge a shared responsibility in maintaining the security of their data. Clients agree to secure any accounts associated with Seattle Accountants Professional Corporation with a robust, complex password that is unique to the system and to enable multi-factor authentication where possible.

Ask a CPA – Get Your Question Answered on YouTube!Have a tax, accounting, or business finance question? Get free expert advice from a CPA!I’m launching a YouTube channel where I answer real questions from business owners, individuals, and entrepreneurs—breaking down complex tax and accounting topics in plain English.How It Works:Submit your questions to hello@seattleaccountants.com

I’ll answer them in detail on my YouTube channel—completely FREE.

Your question(s) will be featured, helping others who might have the same concerns!Important: By submitting a question, you agree that my answer will be public and included in a YouTube video. While I’ll provide valuable insights tailored to your situation, this does not establish a client-CPA relationship.Let’s make tax & accounting simple!Diana Akhmerova, CPA, MST